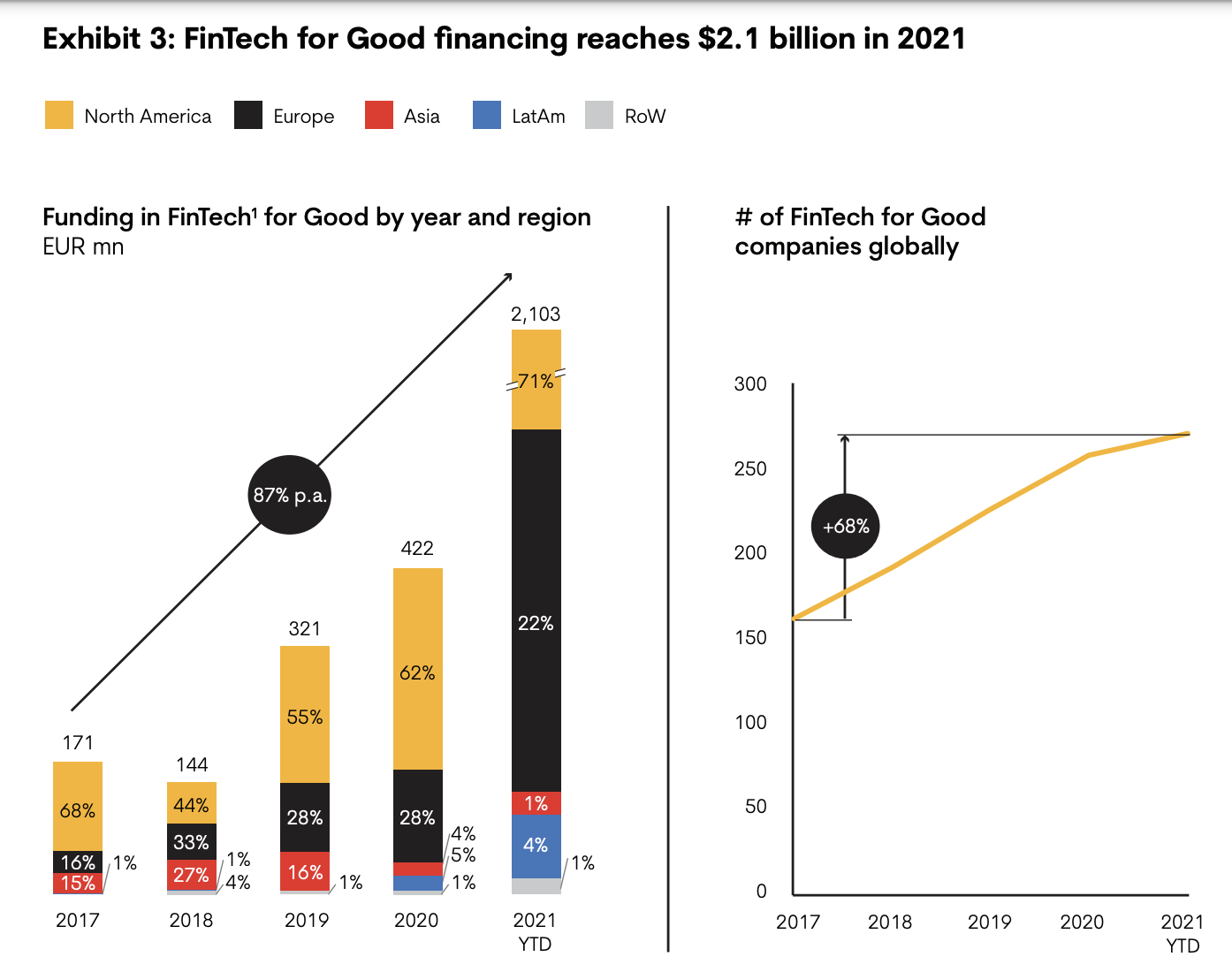

A brand new report collectively produced by McKinsey & Firm, Elevandi and the Financial Authority of Singapore (MAS) reveals that fintech firms may play a major position in serving to to mobilise the capital required to create world sustainability, notably within the effort in direction of decarbonisation (internet zero).

“Fintech could play a significant role in helping to mobilise the capital required to create global sustainability. So far, only a very small portion of the total need is covered through financing. In recent years financing for projects targeting reduced emissions grew, but remained well short of the total needs,” the report states.

There are a number of ways in which fintech firms can contribute to the transfer in direction of internet zero. This consists of the businesses’ technological know-how that’s believed to be “pivotal” in growing and funding improvements associated to carbon seize or the safety of pure sources.

Fintech firms also can play the position of educators in educating shoppers on the implications of the local weather transition for his or her companies and serving to them transfer ahead.

Additionally Learn: ‘There’s a lack of urgency among companies in achieving net zero targets’: Unravel Carbon’s Grace Sai

The report lists particular actions within the fintech trade’s effort to help sustainability which encompasses six identifiable themes:

Sustainable on a regular basis banking

Services and products that match clients’ environmental values, equivalent to rewards for accountable buying.

Affect fundraising

Elevating funds for environmental and social causes.

ESG intelligence and analytics

Sustainability-related knowledge and analytics, ESG scores and analysis companies.

Affect investing and retirement

Alternatives that generate social and environmental influence together with monetary returns.

Inexperienced and accessible financing

Financing for sustainability tasks and offering credit score entry to underserved teams.

Carbon monitoring and offsetting

Monitoring particular person and company carbon footprints based mostly on monetary transactions and figuring out methods to offset them.

What blockchain can do

As one of the vital talked-about topics within the tech trade right now, naturally one could be curious concerning the position that blockchain can play in assembly internet zero objectives. In keeping with the report, blockchain can play a major position within the matter of deconstructing and securing knowledge.

Additionally Learn: Fireside chat: Racing to net zero with the voluntary carbon market

“Given that ESG data is fundamental to sustainability investment and lending decisions, there must be a way to deconstruct the data and verify its integrity. Otherwise, decisions based on this data have the risk of being illinformed and companies remain open to accusations of greenwashing. Blockchain technology could address this challenge,” it explains.

However this expertise isn’t with out criticism. Cryptocurrencies, as the preferred implementation of blockchain expertise right now, are recognized for his or her huge electrical energy use and eventual environmental influence.

There have been a number of initiatives to assist scale back the environmental influence of cryptocurrencies, equivalent to by way of “The Merge” for Ethereum. The swap noticed the cryptocurrency transferring to a brand new algorithm Proof of Stake which is claimed to scale back energy consumption by nearly 100 per cent.

Aside from that, AI and machine studying are additionally the applied sciences which have been named to assist in the method of vouching for the validity of information. “They could seek out and identify data abnormalities that could call into doubt the sustainability claims of particular instruments,” the report says.

Shifting in direction of internet zero

The report confused that in our effort to transition in direction of decarbonisation (internet zero), by 2050, the worldwide financial system would require “the greatest reallocation of capital since World War II coupled with a massive influx of financial innovation.” However as said earlier, thus far, monetary mobilisation in direction of the objective nonetheless leaves a lot to be desired.

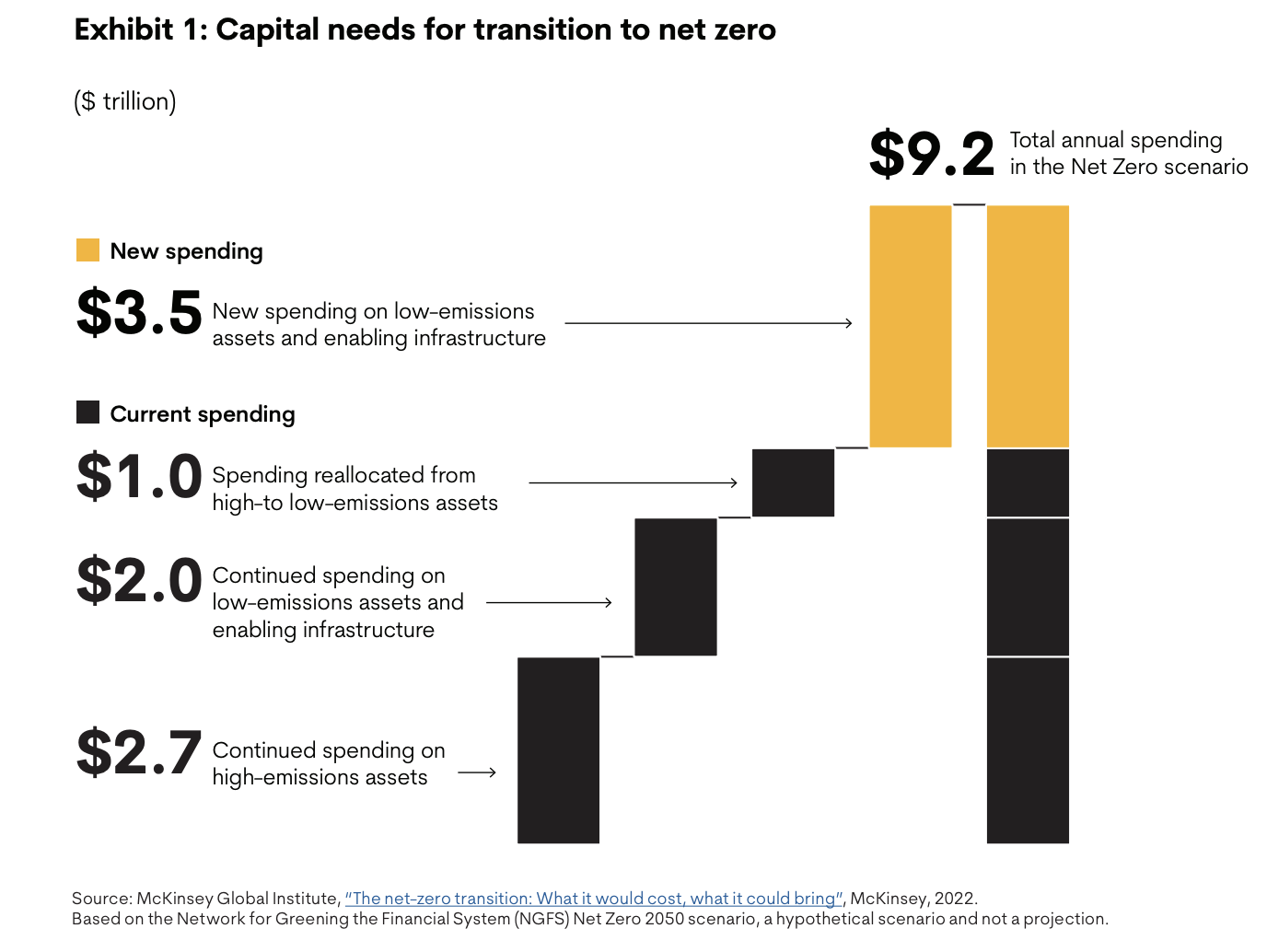

“In its January 2022 report, the McKinsey International Institute (MGI) calculated that capital spending wanted for the transition would whole US$275 trillion between 2026 and 2050 or about US$9.2 trillion a 12 months … The necessity represents

a median enhance in annual spending of about US$3.5 trillion or, for illustration, an quantity equal to about half the annual world company earnings,” the report elaborates.

Additionally Learn: BillionBricks closes US$2.45M seed round to build affordable net-zero homes

The small print are described within the following illustration:

There are additionally different elements that make the prospect appear darker in terms of fulfilling internet zero objectives, not less than quickly. This consists of the COVID-19 pandemic and different current world crises which can power traders to take the safer, extra cautious method in terms of investing.

” … the geopolitical shocks of 2022 would possibly tempt many to put aside sustainability objectives not less than quickly in favour of tried-and-true fossil fuel-based operations, for instance stopping or delaying funding in renewable power sources. This would possibly particularly be true for the manufacturing, transportation, and power sectors,” the report states.

Nevertheless, it highlights that this method is likely to be a “false trade-off.”

“Companies can be flexible and maintain a long-term focus on sustainability while creating the necessary resilience to withstand shocks. Indeed, continued efforts toward sustainability can build energy independence and add substantially to resilience,” it stresses.

Additionally Learn: Singapore’s climate change: Moving towards net-zero through greener buildings and emerging technology

As a way to attain the objectives of decarbonisation by way of this dual-focus method, firms are inspired to discover supplies transition and different inexperienced enterprise approaches early to safe entry to probably the most promising improvements, in response to the report.

It said that whereas the dangers could also be considerably greater for first-movers within the discipline, the rewards are additionally stated to be “proportionally higher”.

“For example, early investors can benefit from policy incentives, skilled talent attracted to cutting-edge employers, partners who are equally willing to explore the potential, and securing a place in emerging value chains,” the report stresses.

—

Fundraising or getting ready your startup for fundraising? Construct your investor community, search from 400+ SEA traders on e27, and get linked or get insights concerning fundraising. Try e27 Pro for free today.

Picture Credit score: Blake Wisz on Unsplash

The submit Understanding the role of fintech, blockchain in transitioning to net zero appeared first on e27.

#asiannews #asian_news